Type: Logistics

Size: 954,370 SF

Tenant: Target

We’re not traditional landlords or conventional finance people. We’re problem solvers. Service providers. Innovators. We develop, own and operate the infrastructure for modern life, including data centers, logistics and life sciences facilities. With deep expertise in how technology and data are transforming these sectors we are able to uniquely address our tenants’ real estate challenges. We are Legacy Investing.

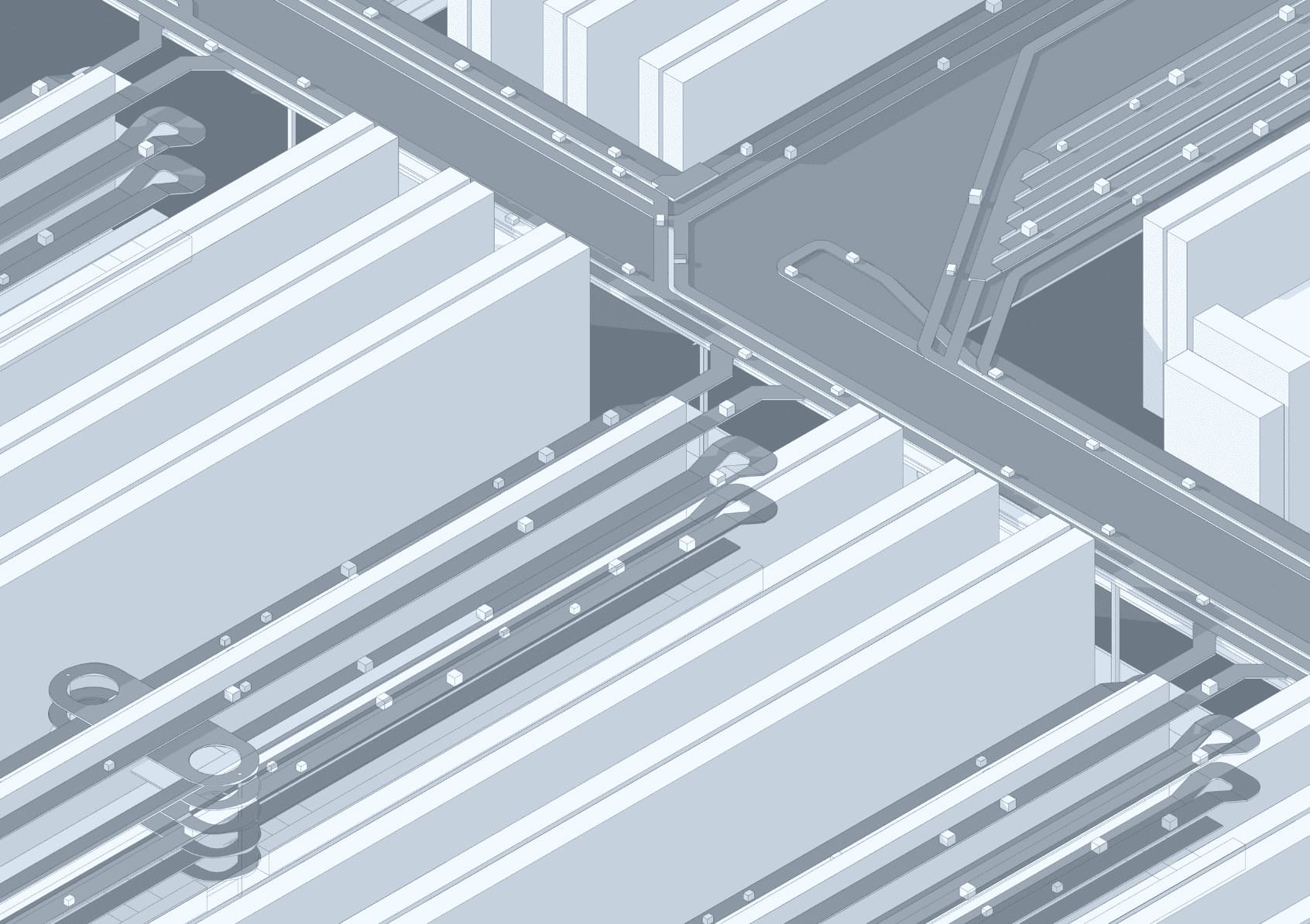

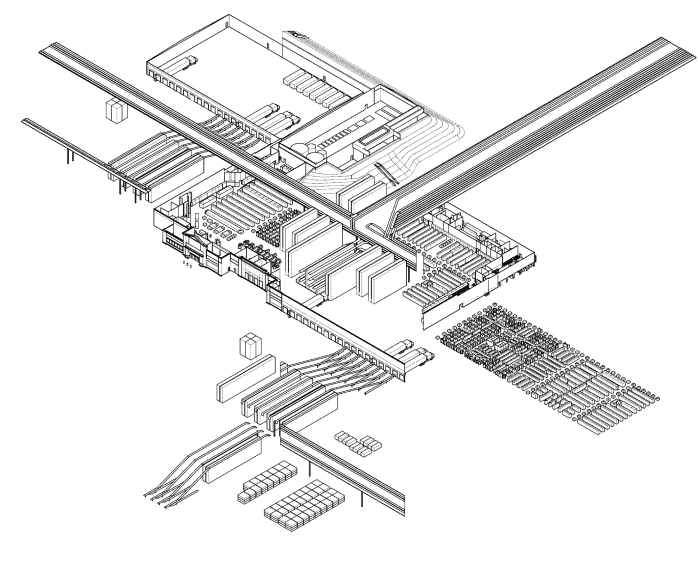

At Legacy Investing, we understand that modern infrastructure facilities are warehouse-scale machines and we know how these machines work from the inside out. We don’t simply see isolated buildings but highly networked and entangled technological systems that form the connective tissue of business operations. As buildings become increasingly impacted by technical systems and performance metrics, we believe it’s imperative to understand these dynamics and be able to manage them to meet tenants’ needs.

To create real value for our clients and partners requires a deep understanding of their needs and having the creativity and capabilities to unlock potential. Companies rely on real estate for their production and distribution networks and we know that a facility optimized to a tenants’ data, processes and protocols propels business forward. That’s why we created Legacy Investing to offer more than space, providing services that enable our tenants to optimize their site locations, building specifications, equipment and operations with the support of our capital.

We are a fully integrated real estate platform that goes beyond the traditional investment framework to deliver comprehensive financial, technical and building solutions. Our unique perspective allows us to look beyond the spreadsheet and solve for true performance to meet our tenants needs.

As buildings become more technologically advanced you need a partner who fully understands the technology crucial to your operation. We know how to design, create, and adapt space to support and enhance these systems.

We focus on real estate across the U.S. and Europe that’s being fundamentally impacted by new technologies. We leverage our extensive understanding of technology to determine how these properties will impact tenant demand, site selection and leasing. We capture long-term real estate value by positioning these properties to meet those needs.

Legacy Investing has been empowering land and building data centers since the B.C. (Before the Cloud) era. We continue to develop, build and empower sites for the future.

We’ve been in data centers for more than two decades. We’ve built a seasoned team of experts across all data center disciplines. That means we can densify, we can go vertical, or horizontally develop infrastructure into powered sites.

Our capital and capabilities can play across the value chain from spec power infrastructure to turnkey facilities.

Our deep relationships across real estate, data center users and the power industry enable us to get the job done.

The Legacy Investing team has extensive expertise in all aspects of data center development, including power infrastructure and facility design.

We deploy capital into powered land, brownfield redevelopments and greenfield data center developments.

Whether you’re a landowner, a developer or an operator looking for a capital partner to empower sites, or an end user looking for a pad-ready, empowered site, Legacy Investing can support you across the value chain.

LEARN MORE

Legacy Investing delivers fully equipped, automated warehouses.

Our team delivers highly automated distribution centers with your preferred building and systems in one lease.

We deliver enterprises their next generation distribution centers:

If you want to learn more about how we can help you reinvent your supply chain, we want to hear from you.

Contact us

Over the past two decades, we've successfully undertaken and completed over 50 investments, spanning logistics, data centers, and life sciences. We have a reputation for delivering on our commitments and a host of long-lasting relationships to show for it.

Our portfolio reflects our depth of understanding. We have the market knowledge, analytical skills, and foresight to identify the true value of a property. We stay ahead of the curve with the technology that is driving different types of real estate needs. We understand the highly networked ecosystems in which these buildings exist.

We have the expertise to uncover potential that’s not immediately apparent. We offer unique opportunities that others overlook. As a result, the Legacy Investing portfolio is full of investments that deliver outsized value—and hold their value—even as technologies and market conditions continue to shift and evolve.

Type: Logistics

Size: 954,370 SF

Tenant: Target

Type: Logistics

Size: 1,220,000 SF

Tenant: Sherwin Williams

SOLD

Type: Logistics

Size: 499,217 SF

Tenant: Dow

Type: Logistics

Size: 481,964 SF

Tenant: Ford Motor Company & Ingram Micro

Type: Logistics

Size: 629,682 SF

Tenant: DHL

Type: Cold Storage Logistics

Size: 419,052 SF

Tenant: Smithfield Foods

Type: Life Science

Size: 125,000 SF

Tenant: Baxter

Type: Life Science

Size: 200,000 SF

Tenant: Avantor, IQVIA

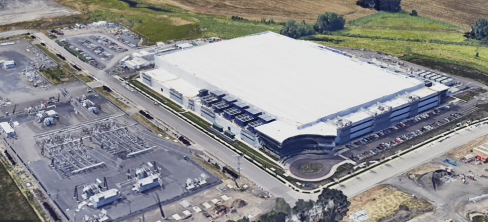

Type: Data Center

Size: 260,000 SF

Tenant: Flexential

Type: Data Center

Size: 275,421 SF

Tenant: Equinix

Type: Data Center

Size: 169,000 SF

Tenant: E*Trade

SOLD

Our leadership team hasn't always been in real estate. We were tenants once, too. We had corporate real estate and finance responsibilities, and we fully understand what it’s like to sit on that side of the table. We know what goes into the complex business and operating decisions companies have to make, and the problems they are working to solve.

Having been founded by two tech entrepreneurs, we also have deep technology and innovation DNA. As buildings become more and more technologically advanced, you need a team who has expertise in the new technologies that are driving today’s business functions. You need a team that isn’t just limited to the four walls but who fully grasps what goes on inside them. And that’s exactly who we are.

Daniel English is a founder and managing partner of Legacy Investing. Daniel leads Legacy’s strategy and investment activities.

Prior to Legacy, Daniel was a tech start-up and public company executive with leadership roles across M&A, corporate development, strategy, and product management. Daniel studied engineering at Carnegie Mellon University and Economics and Finance at Emory University.

Jay Rappaport is a founder and managing partner of Legacy Investing. Jay oversees all transactions and structuring components.

Formerly Jay was CCO at AOL where he negotiated all of AOL’s major transactions, including Time Warner, Netscape, and CompuServe. Subsequently, Jay was President of Vonage and then President and COO of AddThis (sold to Oracle). Jay also served on the Board of Advisors to the Washington Capitals and Wizards.

Ashely Tonnesen serves as COO of Legacy and is responsible for day-to-day operations and financial management.

Ashley previously served as a Director of Finance at Mill Creek Residential Trust, a leading multifamily developer. Ashley began her career in public accounting, and most recently was an Assurance manager at PwC.

Manny Mencia serves as CTO of Legacy, overseeing mission critical technical designs, operations and execution. Manny has over 25 years of leadership experience in the information technology, telecommunications and real estate sectors, with roles including COO of ByteGrid, CEO of CubeCorp, CTO of Optiglobe, and Vice President of MCI.

Legacy Investing

3100 Clarendon Blvd, Suite 1050

Arlington, VA 22201

(703) 665-9932

info@legacyinvesting.com